期货价格跌到负数(期货跌到负数是不是还要欠钱)

Title: Exploring the Phenomenon of Negative Futures Prices

Introduction:

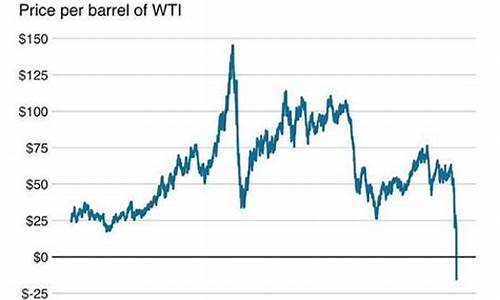

In recent years, the world of finance has witnessed a rare and perplexing occurrence: futures prices dropping into negative territory. This phenomenon, once considered improbable, has sparked widespread curiosity and concern among investors and analysts alike. In this article, we delve into the intricacies of negative futures prices, examining their causes, implications, and potential ramifications for the financial markets.

Causes of Negative Futures Prices:

Negative futures prices occur when the supply-demand dynamics of a commodity market reach extreme levels, leading to a temporary imbalance in trading conditions. Factors such as oversupply, storage constraints, and market speculation can contribute to this phenomenon. For instance, during periods of economic downturns or geopolitical unrest, the demand for certain commodities may plummet, resulting in an oversupply situation that drives prices into negative territory.

Implications for Market Participants:

The occurrence of negative futures prices poses significant challenges and opportunities for market participants across various sectors. For producers and suppliers, navigating the complexities of negative pricing environments becomes paramount, as they must adapt their production and storage strategies to mitigate losses and capitalize on market fluctuations. Conversely, for consumers and end-users, negative futures prices may present unique opportunities for cost savings and procurement strategies.

Navigating Negative Pricing Environments:

In response to the emergence of negative futures prices, regulators and industry stakeholders have implemented measures to enhance market transparency and stability. Initiatives such as improved risk management practices, enhanced liquidity provisions, and greater regulatory oversight aim to safeguard against the adverse effects of extreme price movements and promote confidence in the functioning of futures markets.

Conclusion:

In conclusion, the phenomenon of negative futures prices represents a fascinating yet complex aspect of modern financial markets. By understanding the underlying causes, implications, and regulatory responses to this phenomenon, market participants can better navigate the challenges and opportunities presented by extreme price fluctuations. As the global economy continues to evolve, monitoring and adapting to the dynamics of futures markets will remain essential for investors and industry stakeholders alike.

Key Takeaways:

1. Negative futures prices stem from supply-demand imbalances and market dynamics.

2. Market participants must adapt their strategies to navigate negative pricing environments effectively.

3. Regulatory initiatives aim to enhance market stability and confidence amidst extreme price movements.